Please enable JavaScript to get the full experience of this website.

HOW REALTYSHARES WORKS

Hand-pick investments that align with your financial goals

RealtyShares gives you access to a broad assortment of commercial real estate investment opportunities with minimums as low as $10,000, so you can build a diversified portfolio.

Investments carefully curated by real estate experts

Seasoned real estate operators come to RealtyShares seeking capital

to improve and add value to commercial properties. Every investment

opportunity we offer is vetted, negotiated and analyzed by several

teams of in-house experts before it is available for investment on

the platform.

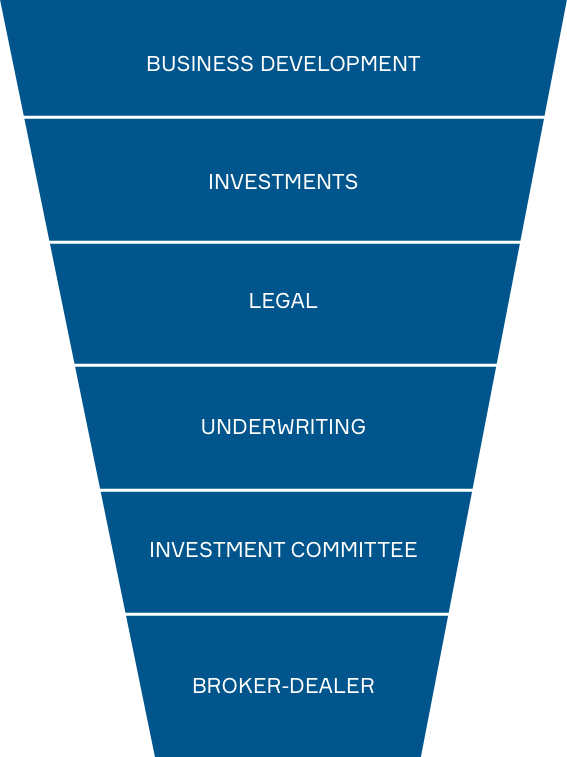

BUSINESS DEVELOPMENT

Builds relationships with seasoned real estate operators with expertise in their markets and sources commercial real estate investment opportunities for review

INVESTMENTS

Identifies the most promising opportunities, analyzes and assesses the proposed business plans and negotiates the investment structure and fees

LEGAL

Reviews the opportunity, drafts operating agreements and negotiates operating structure to ensure the appropriate legal rights designed to protect investor capital are in place

UNDERWRITING

Performs extensive review of all diligence items, verifies the analysis and assumptions and stresses various scenarios to ensure the investment meets our standards

INVESTMENT COMMITEE

Provides final sign-off on an investment opportunity from senior leaders across every department

BROKER-DEALER

Reviews and approves the offering materials that are presented to investors

<10%

Of the hundreds of investment opportunities we review each

month, fewer than 10% meet our rigorous standards.

We’re with you throughout the entire lifecycle of your investment

We are thinking about our investors from the moment we receive an opportunity until we have fully exited the investment.

BEFORE YOU INVEST

ANALYZE

We evaluate the risk versus the prospective return

NEGOTIATE

We negotiate the deal structure with the sponsor

OFFER

We produce detailed information on the investment opportunity

SUPPORT

We strive to help investors achieve their goals.

AFTER YOU INVEST

MONITOR

We care about the performance of the investment.

UPDATE

We inform our investors through an individualized dashboard.

MANAGE

We take action on your behalf.

EXIT

We’re with you until the end.

Choose investments that meet your risk and return objectives

Selecting investments with different risks and return profiles is

one of the best ways to diversify your real estate portfolio.

Common Equity

Return objective

Not fixed; investors share in net profits of property, including asset appreciation

Typical distribution objective

Quarterly

Tax benefits

Pass-through of depreciation and mortgage expense deductions; some capital gains treatment also possible

Tax filing

K1; State tax filing required for investments made in states that tax income

Preferred Equity

Return objective

Fixed, usually current payments and potentially accrued return paid at exit

Typical distribution objective

Monthly

Tax benefits

N/A

Tax filing

1099 or K1; State tax filing required for investments made in states that tax income

Debt

Return objective

Fixed, usually interest-only payments

Typical distribution objective

Monthly

Tax benefits

N/A

Tax filing

1099

We deliver payouts straight to your bank account*

Here’s what to expect when you invest on the RealtyShares platform.

* distributions are not guaranteed and may not happen.

DEBITING FUNDS

MONITORING PERFORMANCE

RETURNS & DISTRIBUTIONS

You will be notified 24 hours before investment funds are debited from your bank account.

Communications regarding your investments, including accrual dates and distributions, will be posted to your dashboard.

Distributions are made directly to your bank account either monthly or quarterly, depending on the performance of the investment.

Getting started is easy

Schedule a call with your representative and start building your portfolio.

Start Investing